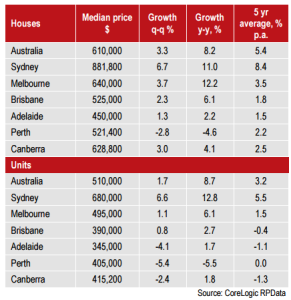

Sydney and Melbourne were star performers year on year to 30 June with both recording double digit growth. Sydney now has a 5 year average annual growth rate of 8.4%pa.

Western Australia’s residential property (in all locations and price bands) continues to experience weakness as a consequence of economic adjustments post the mining and resources boom.

The further recent cut in official cash rate to 1.50% by the RBA will have a positive impact on demand for FY17 albeit that the banks will not likely pass on the full 0.25%pa reduction in interest rates.

Home buyer confidence in WA remains weak however is very sound on the east coast (NSW, Vic and Qld) and as such prices are not expected to rise in WA while modest gains continue on the east coast.

Performance statistics:

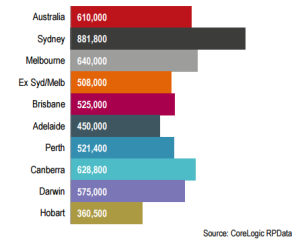

Current national median house prices:

Perth now has the third lowest (ahead of Adelaide and Tasmania) median house price in Australia which gives me some comfort around relative value. The challenge is that there are very few property experts making the call that the Perth market is at a low point. One of the factors suppressing values in WA is the softness of the rental market. The benefit of falling interest rates is being offset by falling rental yields which means investor demand continues to remain weak and will probably continue to do so until there is a recovery in the rental market.

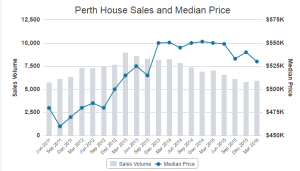

Perth house sales

Median house price continues to drift lower (down from $530,000 in March 2016 to $521,400 at 30 June 2016) in line with lower sales volumes (buyer demand) and the high supply of properties on the market for sale (approx. 15,000 being the highest number for at least 5 years).