There are several important factors to consider when comparing your equipment finance options. First and foremost you should first consider issues in relation to the proposed asset ownership structure and the type of finance as both these aspects can significantly impact your taxation and asset protection outcome.

Ownership structures include companies, trusts, partnerships and sole traders

The most common finance types are chattel mortgages, leasing, rental and hire purchase. These ‘on balance sheet’ or ‘off balance sheet’ structures can have very different effects on your profit and loss and balance sheet results due to the different treatment of the asset ownership and finance expense.

Once past these two steps here are some other key considerations:-

Monthly repayment and interest rates

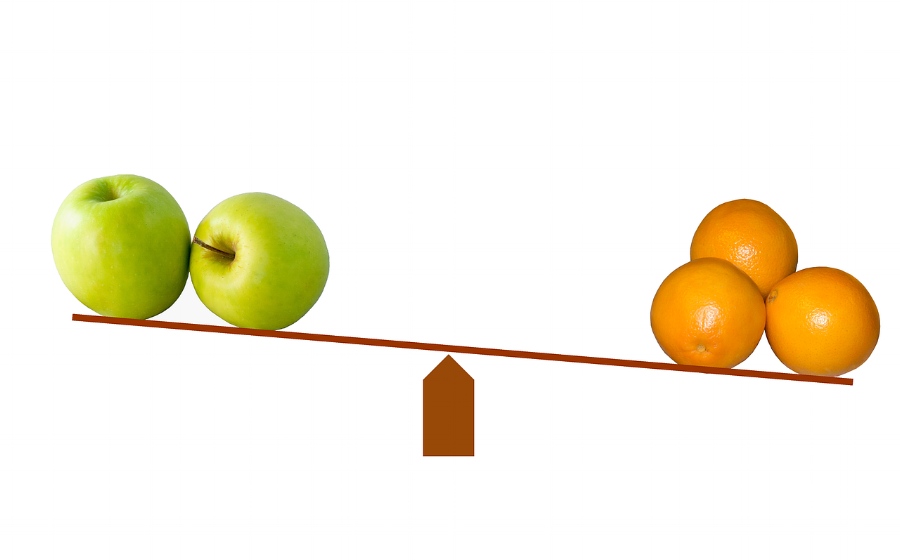

Make sure you compare apples with apples. The best way to compare finance options is to focus on your repayments and less so on an interest rate.

Repayments can be adjusted to take into account seasonal income profiles so that your repayments are high in months when you generate your highest revenue and low in the ‘off season’.

Fees & charges

Origination fees, monthly administration fees, documentation and search fees and buy back fees are just a few cost types that need to be considered.

Loan term and balloon/residual payment

All plant and equipment finance loans have principal and interest repayments due to the depreciating value of these assets.

The longer the loan term and the higher the end of term balloon amount the lesser your monthly loan payments. Make sure any comparison takes these two aspects into account.

Ideally the finance term should have relevance to the likely income generating period of the asset and the expected residual value of the asset at the end of that term.

End of term costs

Non ownership finance structures such as rental agreements can be very attractive however beware of the end of rental term costs and charges. In some cases there are ‘buy back’ provisions to enable you to buy the equipment at the end of a rental term. Ensure these end of term costs are not too onerous.

Choosing the right ownership structure and finance structure are decisions best made in conjunction with professional tax and finance advice. Thereafter it’s all about assessing the interest rate, costs, fees and repayment structures.