The ANZ bank and the Property Council of Australia have published their September quarter 2017 outlook which gauges the sentiment of 1,700 property industry respondents about the outlook for Australia’s national and state economies, views on property asset class performance, employment intentions, expected work flows and critical industry drivers.

Here’s a look at the key findings.

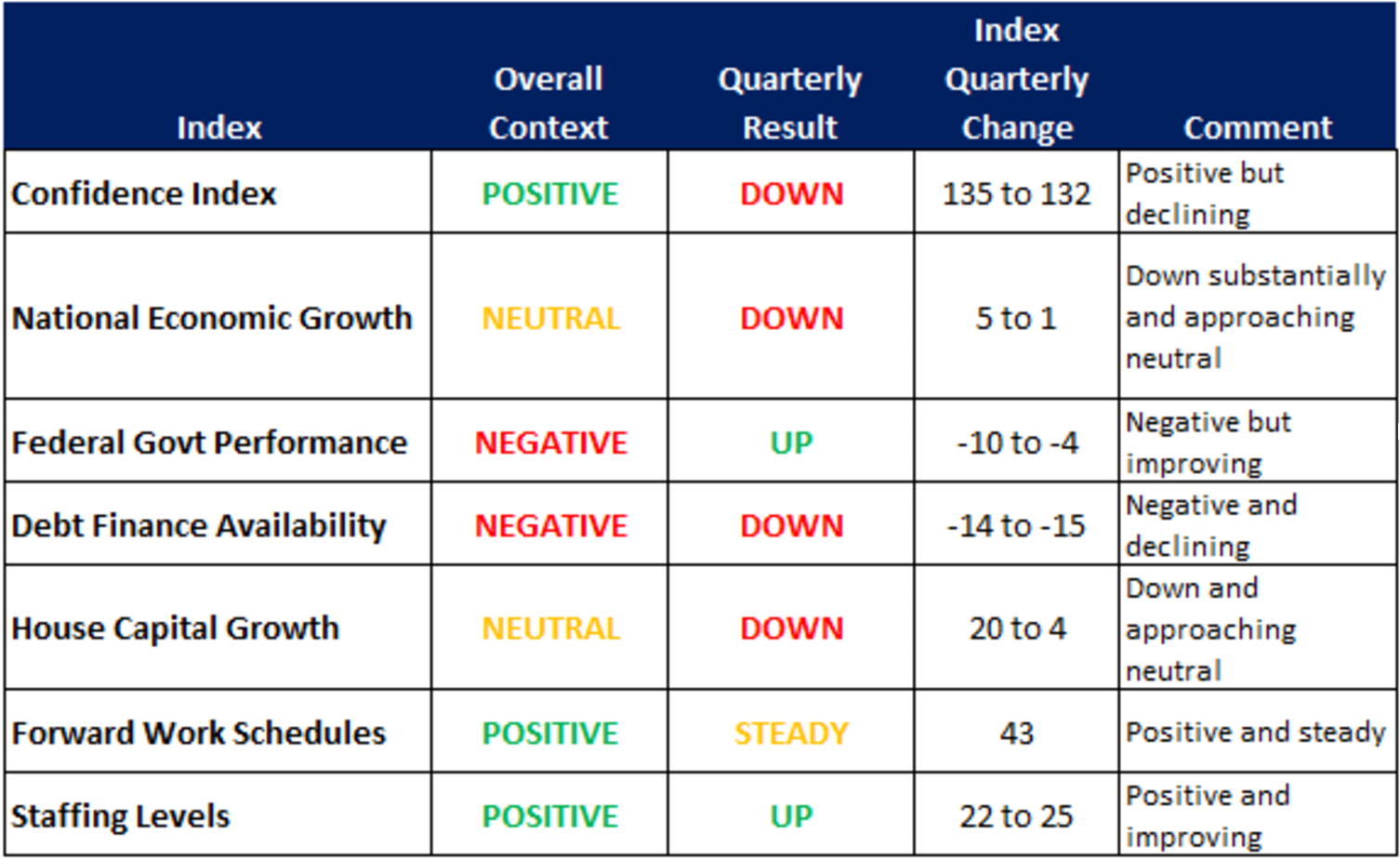

Source: Property Council Research

- Business confidence has eased slightly however remains soundly positive (above neutral levels).

- Sentiment in most regions is higher than a year ago, especially in the mining states of Queensland and Western Australia. WA confidence levels are the highest in three years according to ANZ.

- Sentiment in the housing market has declined. The impact of APRA’s regulation appears to be taking hold and the ANZ believes the housing market will cool through 2017 and 2018. Tighter bank funding conditions are being reported across all sectors of the property market with the impact being most pronounced in the residential sector.

- The retail sector is facing numerous headwinds beyond any anticipated Amazon effect, recognising the continued pressure on disposable incomes across Australia, including escalating energy prices.

- In commercial property, the trend improvement in the outlook for the offices segment is noteworthy. Strong employment growth in white-collar office jobs appears to be supporting sentiment, such that offices are now the most optimistic segment for the first time.

- Confidence in industrial property also nudged higher from already record levels, likely helped by the raft of infrastructure projects across the eastern seaboard.

- Expectations of national economic growth over the next 12 months fell sharply in the September survey, with a softer outlook reported across all states and territories. It is likely that the pessimism surrounding Australia’s weak Q1 GDP result weighed heavily on this survey. 2017 has certainly got off to a sluggish start, and a number of headwinds will persist, including the impact of Cyclone Debbie, the housing sector moving past a peak, and a soft retail environment.

- On the other hand, firms are reporting that their labour requirements for the coming year continue to rise. Staffing expectations pushed higher to a new record level, joining a raft of indicators suggesting that demand for labour remains solid.

- Job advertisements have been trending higher for some time, while business profitability and capacity utilisation are sitting at elevated levels, all of which bode well for employment growth.

- We have already seen strong employment growth over recent months, with unemployment falling to 5.5% in May – the lowest rate since March 2013. The underlying positive conditions in the labour market are encouraging.

In summary, this continued low growth/low inflation environment presents a significant policy challenge for the RBA and Government given the starting point of a low cash rate, fiscal deficits and high household debt. For monetary policy, THE ANZ forecasts growth to ‘muddle’ through and inflation to very slowly recover. As such the RBA (interest rates) should remain on hold for some time.